Notes to the financial statements

1. General Information

PSAA is responsible for appointing auditors to local government, and police bodies, for setting fees.

The company is limited by guarantee and has no share capital. The principal members of the company are set out in Note 15.

The company is incorporated and domiciled in the UK. The address of its registered office is: Local Government House, Smith Square, London, SW1P 3HZ.

2. Statement of compliance

The individual financial statements of PSAA have been prepared in compliance with United Kingdom Accounting Standards, including Financial Reporting Standard 102 The Financial Reporting Standard applicable in the United Kingdom and the Republic of Ireland (FRS 102) and the Companies Act 2006, under the provisions of the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 (SI 2008/410).

3. Summary of significant accounting policies

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

a) Basis of preparation

These financial statements are prepared on a going concern basis, under the historical cost convention.

The financial statements are prepared in sterling, which is the functional currency of the company. Monetary amounts in these financial statements are rounded to the nearest £’000.

b) Public benefit entity

Under FRS102, PSAA qualifies as a public benefit entity and therefore the special provisions of section 34 of FRS 102 could be applicable. These provisions have been reviewed and are not relevant to this financial year, as PSAA did not make any business combinations and did not receive any concessionary loans. The provisions will be kept under review.

c) Going concern

The financial statements have been prepared on the going concern basis. Our disclosure following our assessment of going concern is included within the Directors’ report. We are operating under the appointing person regime for the five years from 1 April 2018.

d) Revenue recognition and the treatment of surplus funds

Revenue and associated costs are recognised, excluding VAT, in the accounting period in which the services are rendered, when the outcome of contracts can be estimated reliably. The company uses the percentage of completion method based on the actual service performed as a percentage of the total services to be provided.

Scale fees belong to and are set by PSAA. For administrative convenience, PSAA requires audit firms to bill audited bodies on its behalf and to act as its agents to collect fees. PSAA invoices firms at the scale fee adjusted for the firm’s agreed remuneration. Firms are required to update quarterly work in progress returns with the amount of work they have completed in the quarter to establish the percentage complete. The revenue received by PSAA is to cover directly the costs of the auditors and the operating expenses of PSAA. If at the end of the period there is a remaining surplus or a shortfall, as a result of expenses being over or under-estimated, revenue is adjusted to the actual amount receivable from the audited bodies and payable by PSAA in total. Surplus funds are repaid to the audited bodies the surplus was generated from; however, the repayment date and method are to be determined by the Board. Until a decision is made to return specific funds, all potential surplus funds are shown as a liability in the form of deferred income, as PSAA has a constructive obligation to repay the funds. Once a decision is made by the Board to return specific funds the amount outstanding at the year-end is shown as creditors.

PSAA accounts for and reports on the transitional arrangements and appointing persons separately.

PSAA will account for and report on each appointing period separately to enable PSAA to return surplus funds back to the bodies that opted-in the particular appointing period. The bodies opted-in may vary from one period to another, and the distribution will match the opt-in period. If a body ceases to exist then the appropriate share of the distribution may be due to a specific successor body (ies) in which case it will be paid to the body (ies) concerned. If a new body is created within an appointing period, the amount due to it will be based on the proportion of the appointing period for which the body existed.

e) Corporation tax and deferred tax

The company is liable for corporation tax on its profits, but it will not have any trading profits as it accounts for its trading activities on a no profit/no loss basis. As a consequence, there is no deferred tax in the financial year. The company is liable to corporation tax on investment income.

f) Provisions

Provisions are recognised when PSAA has a present legal or constructive obligation as a result of past events; it is probable that an outflow of resources will be required to settle the obligation; and the amount of the obligation can be estimated reliably.

g) Employee benefits

PSAA provided a range of benefits to employees including paid holiday arrangements and a defined contribution pension plan.

- Short term benefits

Short term benefits including holiday pay and other non-monetary benefits are recognised as an expense in the period in which the service is received. - Defined contribution pension plan

PSAA operates a defined contribution plan for its employees. A defined contribution plan is a pension plan under which the company pays fixed contributions into a separate entity. Once the contributions have been paid, PSAA has no further payment obligations. The contributions are recognised as an expense when they are due. Amounts not paid are shown as accruals in the balance sheet. The assets of the plan are held separately from the company in independently administered funds.

h) Financial instruments

Financial instruments are shown as follows:

- trade and other receivables at their nominal amount;

- deferred income at nominal amount. Amounts falling due after more than one year mainly represent potential surplus fees to be repaid to audited bodies at a future date. The potential surplus fees will be repaid in accordance with a formula which will be agreed by the Board, therefore deferred income falling due after more than one year is also reported at nominal amount;

- trade and other payables at their nominal amount;

- short-term financial assets, cash and cash equivalents are held by the LGA on PSAA’s behalf in line with PSAA’s treasury management policy. These balances are deposited in accordance with the PSAA’s investment strategy. These are stated at their nominal value, which approximates to fair value because of their short maturity period of the assets.

i) Contingent Liabilities

PSAA indemnifies appointed auditors for legal costs they incur when carrying out their special legal functions that are otherwise irrecoverable. The amount incurred in any one year from this indemnity depends on the progress of individual cases and so cannot be predicted or quantified until any liabilities crystallise. The indemnity under the Appointing Person arrangements is capped at £50,000. The indemnity under the transitional arrangements is not capped.

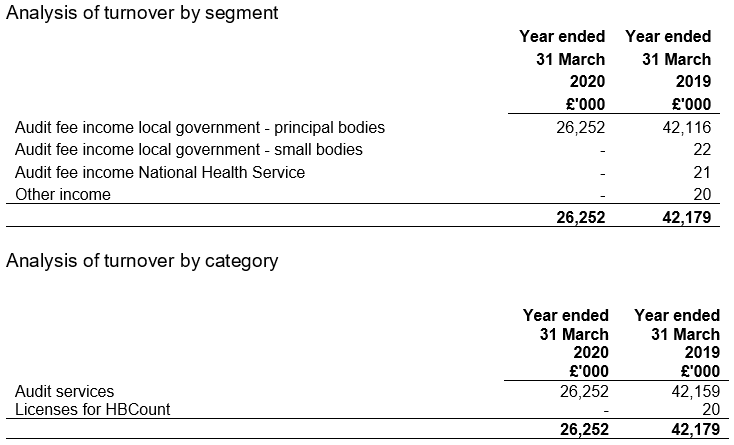

4. Turnover

5. Cost of sales

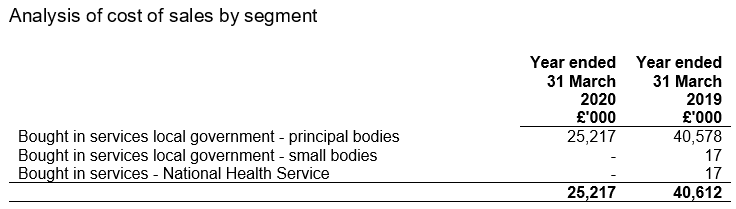

6. Administrative expenses

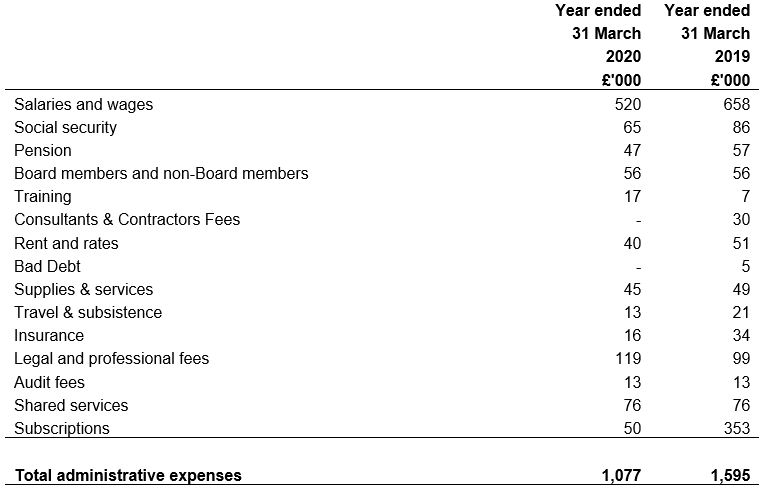

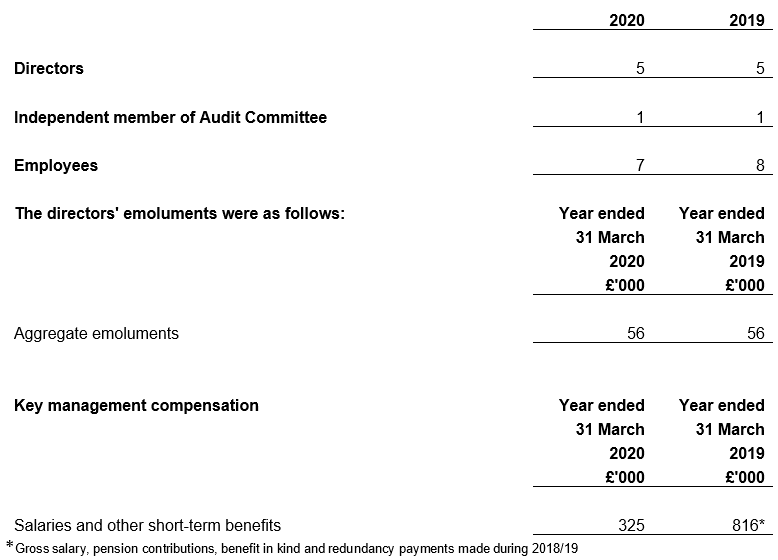

7. Directors, independent member of audit committee and Employees

The average monthly number of persons employed by the company during the year was:

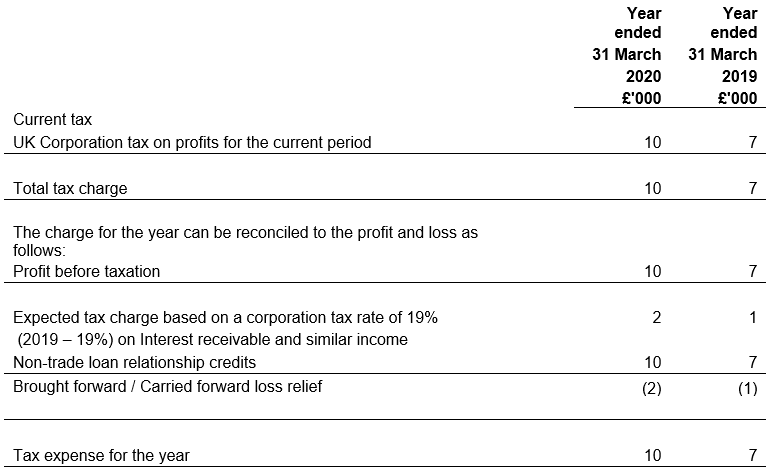

8. Taxation

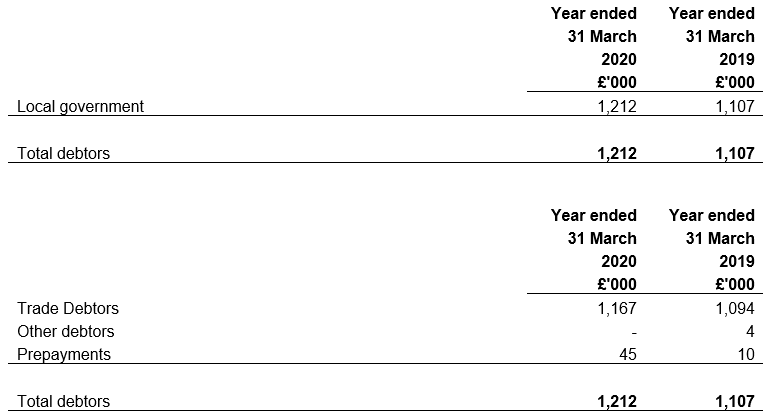

9. Debtors

This note provides an analysis of the debtors shown in PSAA’s Balance Sheet.

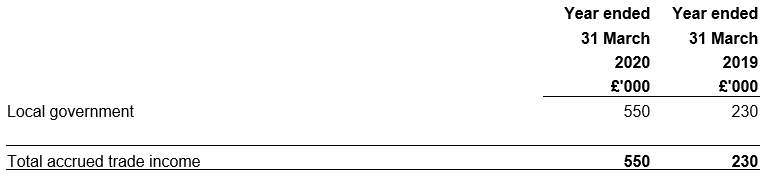

10. Accrued trade income

This note provides an analysis of the accrued trade income (work completed, but not yet billed) shown in PSAA’s Balance Sheet.

11. Current asset investments

Surplus cash balances are lent to financial institutions on the brokers approved counterparty list. Investments are typically for periods not exceeding twelve months and as such the loan amount is a reasonable assessment of fair value. The counterparty list is currently restricted to financial institutions that meet agreed credit ratings criteria and subject to the cash limits (per counterparty) as shown in PSAA’s Investment Strategy agreed by the PSAA Board. PSAA’s Investment Strategy strictly applies credit limits for all financial institutions on the approved counterparty list to ensure that investments are diversified. No credit limits were exceeded during the year and PSAA does not expect any losses on short term investments.

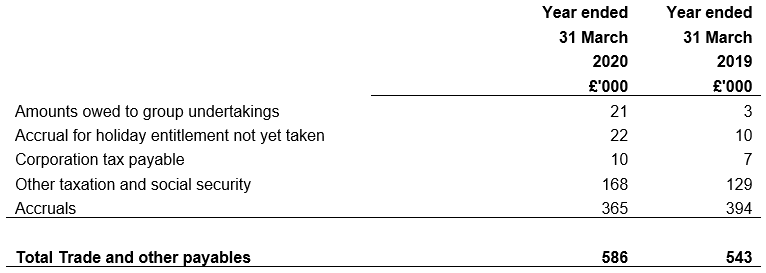

12. Trade and other payables

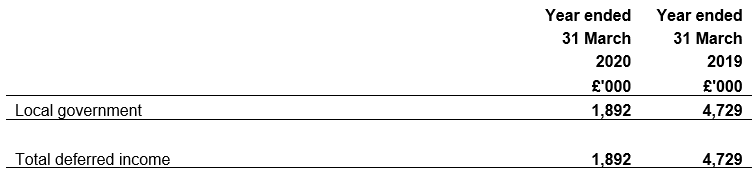

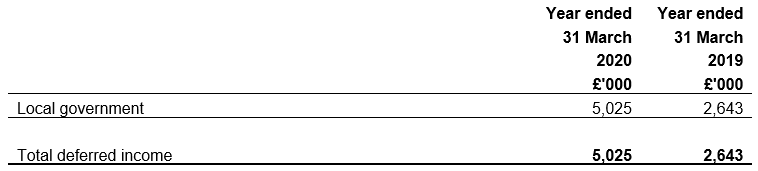

13. Deferred income

Deferred income represents invoices raised in advance for work the firms have yet to deliver and surplus fees to be paid to audited bodies at a future date.

£1.672m of the £1,892m deferred income due within 1 year relates to invoices raised in advance for work the firms have yet to deliver (work in progress) under the Appointing Persons regime. The balance of £0.22m is the remaining amount payable to local authorities under the transitional arrangements following the Boards decision in December 2019 to distribute surplus funds of £3.5m. £3.3m was paid by 31 March 2020 and the remaining amount will be paid in 2020/21.

£1.744m of the £5.025m deferred income falling due after more than 1 year relates to the transitional arrangements and £3.281m relates to the Appointing Persons regime. Once it is clear the money is not required to meet PSAA costs the funds will be returned to audited bodies, in accordance with a formula to be agreed by the Board (as explained in note 3d above).

Deferred income – falling due within 1 year

Deferred income – falling due after more than 1 year

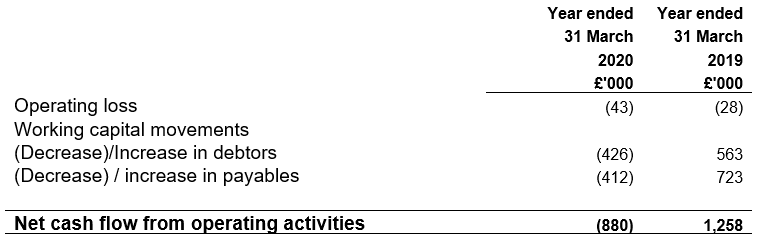

14. Cash flow

Note to cash flow statement

15. Related party transactions

PSAA is wholly owned by the Improvement and Development Agency (IDeA), which is wholly owned by the Local Government Association (LGA). The LGA has taken the decision not to consolidate PSAA’s accounts. Below (in italics) is an extract from the LGA’s annual report: ‘The accounts for Public Sector Audit Appointments Limited (PSAA) are not consolidated into these statements because the LGA does not exercise or have the ability to exercise control over PSAA and the LGA is not in a position to benefit from its results and financial performance.’

The IDeA and the LGA are treated as related parties in these accounts in the interest of transparency. During the year PSAA received services from the LGA, such as IT, HR Finance support and accommodation, the total value of these services was £145,512 (2019: £138,959). To date PSAA has paid a total of £124,554 in this financial year. £20,958 (2019: £2,890) is owed by PSAA to the LGA.

During the year there were no related party transactions carried out either by Directors or the management team (the Chief Executive and three senior managers).

There were no transactions between PSAA and the key management personnel other than the compensation and expenses set out in the Remuneration Report.

16. Contingent liabilities

At the end of 31 March 2020, PSAA had no contingent liabilities.