Strategic report

1. Objectives and operating environment

The directors present their strategic report for the year ended 31 March 2022.

PSAA’s responsibilities and aims are expressed through a series of objectives, set out in our Articles of Association, covering the following areas of activity:

- appointing auditors to relevant authorities;

- consulting on and setting a scale or scales of fees, and charging fees, for the audit of accounts of relevant authorities;

- ensuring that public money from audit fees continues to be accounted for properly and is protected;

- overseeing the delivery of consistent, high quality and effective audit services to relevant authorities;

- ensuring effective management of contracts with firms for audit services to relevant authorities;

- being financially responsible having regard to the efficiency of operating costs and transparently safeguarding fees charged to opted-in bodies; and

- leading our people as a good employer.

A memorandum of understanding with key partners including DLUHC and the LGA sets out the broad framework in which PSAA operates for the transitional arrangements. It contains the agreed principles regarding PSAA’s operation and the mechanisms for its accountability for, and safeguarding of, public money in the form of audit fees charged to opted-in bodies. An updated MoU is being developed to support the governance and working arrangements between the parties following the outcome of the current procurement.

The Board believes that strong corporate governance supports the future long-term success of PSAA. It has in place a comprehensive governance framework to support the company’s functions as an appointing person. The Board takes very seriously its duty under Section 172 of the Companies Act 2006 to promote the success of the company. The Act states that ’A director of a company must act in the way he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole, and in doing so have regard (amongst other matters) to:

- the likely consequences of any decision in the long term;

- the interests of the company’s employees;

- the need to foster the company’s business relationships with suppliers, customers and others;

- the impact of the company’s operations on the community and the environment; and

- the desirability of the company maintaining a reputation for high standards of business conduct.’

The Board has satisfied itself that consideration of the requirements of Section 172, and the directors’ duties under it, have informed and guided its work throughout the year. The details below explain how PSAA has had regard to promoting the success of the company in relation to each of the specific requirements of the legislation.

(a) The likely consequences of any decision in the long term

All decisions are taken with due regard to PSAA’s purpose and objectives (as set out in the Articles of Association and other relevant documents), the effective and efficient use of public funds and meeting our statutory obligations as an Appointing Person.

The Board considers how to promote the long-term success of PSAA on a continuous basis, providing effective leadership and oversight of the company’s work and functions. It also ensures that PSAA plays an active role in discussions with partners concerning the development of the local audit system as a whole. The Board is mindful of the fact that PSAA’s success depends to a large extent upon the ability of the wider system to deliver for and meet the needs of opted-in bodies and users of audited accounts. With this in mind PSAA meets and works closely with other key players in the local audit system seeking to influence decisions for improvement of the system overall.

PSAA is represented on the Local Audit Liaison Committee (LALC) along with representatives of relevant government departments, the NAO, the FRC, ICAEW, CIPFA, and NHS England. The LALC is chaired by DLUHC and was established in 2021 to provide a joined-up response to the challenges and emerging priorities across local audit.

PSAA has in place a Business Plan for 2021/22 which sets out plans for the next year. The plan is designed to be flexible to respond to system and market developments as well as any relevant Government decisions. It is regularly monitored by the Board against a suite of KPIs.

The five-year Medium Term Financial Plan (MTFP) reflects a healthy financial position. PSAA operates on a not-for-profit basis. From time to time the Board approves the distribution of surplus funds to opted-in bodies after ensuring PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. The transitional arrangements (2015-2018) and each appointing period are accounted for separately in the MTFP to acknowledge the different groups of bodies receiving services from PSAA at each stage. The Board regularly reviews the company’s financial position at Board meetings, including the most up-to-date forecast. The annual accounts are approved following scrutiny by the Audit Committee. The treasury management policy is also reviewed annually by the Audit Committee which makes recommendations to the Board as appropriate.

(b) The interests of the company’s employees

PSAA aims to be a good employer, encouraging a culture of openness and transparency, developing people to the best of their abilities and offering competitive remuneration and benefits to recruit and retain staff. The Board recognises that a team of well qualified staff is critical to the success of PSAA. To this end, the Board monitors each of the company’s work streams and related capacity via regular updates from the Chief Executive.

The company’s structure is designed to ensure that PSAA is fit for purpose to fulfil the company’s appointing person responsibilities including supporting the periodic requirement to undertake major procurement projects. The roles in the structure are filled by employees with the necessary skills, qualifications and experience. We encourage and fund staff to attend training and development activities including, where staff are members of professional accountancy bodies, in order to fulfil continuing professional development obligations. Employees have access to the LGA e-learning platform (provided as part of the agreement with the LGA for back office support services) for training on a variety of topics including annual mandatory refreshed training on IT security and information governance.

As a result of the pandemic, staff have worked remotely since March 2020. The Board has recognised the importance of supporting the workforce during this difficult period and has put in place measures to ensure that staff are able to work effectively and remain connected. This has included regular team check-ins and manager contact, financial support to purchase office equipment for use at home, and access to the Employee Assistance Programme.

During 2021 we commissioned an independent review of working arrangements. A key element of the review involved listening to staff and taking on board their views for the design of a model for effective working for the future. The recommendations for a combination of home working and flexible use of office space as appropriate to accommodate effective working and personal preferences were fed back to the team.

Given the challenges faced by both our suppliers and PSAA, the Board reviewed PSAA’s staff establishment and recognised the need to enhance the existing structure to deal with a much greater volume of fee variations than experienced previously. The Board approved a new post of Assistant Finance Manager and various other changes, though without any overall increase in the total number of posts in the structure.

With a small team, good communication is imperative. Board and audit committee papers are accessible to all staff. All employees are kept up to date with items considered at Board meetings and in relation to PSAA’s finances, and these are standing agenda discussion items at weekly team meetings.

We commission consultants for specific research projects where it is appropriate to do so, which brings in extra capacity and specialist skills to support the internal team.

(c) The need to foster PSAA’s business relationships with suppliers, customers and others

Positive business relationships are recognised to be critical to PSAA’s success. Relationships with audit providers are of vital importance. Local audit requires specialist knowledge and expertise. Retaining existing suppliers and, if possible, encouraging new firms to enter the market will help to ensure that the market remains sustainable and competitive and is able to provide the required capacity.

Close links and open communications with opted-in bodies enables us to understand and better meet sector needs. The Board is also committed to building and maintaining strong, effective links with those organisations which perform specialist roles in the new local audit system so that the system as a whole operates efficiently and in a way that meets the needs of opted-in bodies and users of accounts.

We have a communications strategy which identifies our key stakeholders and the channels of communication through which we engage with each group. We keep this under constant review.

The long-term success of PSAA is therefore critically dependent on the way we work with our customers, suppliers and other stakeholders.

Our customers

Our customers under the appointing person arrangements are opted-in local authorities, police, fire and other local government bodies. We operate on a not-for-profit basis, and any surpluses are returned to the opted-in bodies.

We engage with our customers through a variety of different means:

- We have an Advisory Panel whose members represent the finance communities within different types of opted-in bodies. This forum provides an important mechanism for communicating with our opted-in bodies by cascading information and obtaining helpful feedback and insights into all aspects of our national scheme and procurement arrangements. This has been particularly useful in relation to our preparations for the second appointing period and has enabled us to engage with bodies on opt-in arrangements.

- We ensure that all stakeholders have sufficient information and time to enable them to respond effectively to our consultations, (for example, in relation to fees and appointments) and to our invitation to join our national scheme for the second appointing period. Additionally, relevant bodies are consulted in relation to any changes to our new auditor appointments in accordance with PSAA’s governance framework.

- Our Local Audit Quality Forum (LAQF) has been set up to provide an important channel for communicating and engaging with both officers and members of opted-in bodies. The forum provides a meeting place in which all of the parties that have a responsibility for audit quality can share experiences and good practice. In particular we aim to help local audit committees to play their critical and demanding roles effectively. Throughout 2021/22 the LAQF events were held online because of the Covid-19 restrictions.

- We hosted five LAQF webinars for opted-in bodies designed to provide information and answer questions on different aspects of the appointment scheme including key aspects of our work. In addition we organised three webinars specifically to discuss our draft prospectus with eligible local bodies. Using this platform, we were able to reach out to bodies and audit suppliers. These events attracted over 300 attendees from eligible bodies, existing and potential suppliers. Given the success of these events, we plan to continue with this form of delivery and are developing a further programme of webinars for 2022/23.

- We have collaborated with the LGA and CIPFA to develop and deliver a leadership essentials training course specifically tailored to meet the needs of audit committee chairs. This training is provided to LGA member organisations.

- Annually we survey opted-in bodies as part of our monitoring arrangements in respect of the quality of the audit services they are receiving. The results of the second survey in respect of the 2019/20 audits were reported in August 2021. The key messages were discussed with the audit firms and feedback was used to inform the design of the procurement documentation for the second appointing period.

- During the year we engaged with our opted-in bodies on a number of topics and issues including our procurement strategy through presenting at a number of local finance, audit and networking group events.

- We introduced a monthly e-bulletin as a platform for providing information on a regular basis to bodies on a wide range of topics including PSAA updates and events, the opt-in and procurement processes, and wider local audit issues and developments in the sector.

Our suppliers

Our main suppliers are the audit firms with whom we contract to provide audit services to our opted-in bodies. The development of strong, long-term relationships with audit firms is not only critical for delivering quality audit services under the current contract but also for developing our procurement strategy and the future sustainability of the local audit market.

The resourcing difficulties and other challenges which emerged during the course of the audits of the 2018/19 accounts resulted in the target publishing date for audited accounts by 31 July 2019 being missed for a significant number of audits. This continued to be a problem for 2019/20 audits. There was a further significant deterioration in the position for 2020/21 audits.

| Audit year | Target publishing date | Audits missing target date (%) | Audits missing target date (number) |

| 2018/19 | 31 July 2019 | 43% | 208 out of 486 |

| 2019/20 | 30 November 2020 | 55% | 268 out of 478 |

| 2020/21 | 30 September 2021 | 91% | 433 out of 474 |

We are concerned and disappointed that these difficulties have arisen and recognise the importance of auditors meeting the target deadline wherever possible. We are very conscious of the disappointment of opted-in bodies whose audited accounts were not published by the target dates and of the disruptive impact of delayed audits on the work plans of those bodies.

The challenges posed by Covid-19 have contributed to the current position. However, a range of further pressures documented in the Redmond Report are also continuing to impact on performance. In particular there is a shortage of auditors with the knowledge and experience to deliver the required higher quality audits of statements of accounts, which increasingly reflect complex structures and transactions, within the timeframe expected. The growing backlog of audits is in itself a significant concern, with 51 (11%) of the 2019/20 audits and 228 (48%) of the 2020/21 audits still incomplete at 31 March 2022.

In May 2021 the Public Accounts Committee considered the findings of the NAO report Timeliness of local auditor reporting on local government in England, 2020 (nao.org.uk). The report concluded that since the last review of local authority governance and audit in 2019, despite efforts by the various organisations involved in the local audit system and by DLUHC, the local audit system is exhibiting signs of increasing stress. The increase in late audit opinions, concerns about audit quality and doubts over audit firms’ willingness to continue to audit local authorities all highlight that the situation needs urgent attention. Our CEO, Tony Crawley appeared before the PAC, responding to questions spanning all of these themes. The Committee published its report “Local auditor reporting on local government in England” which can be found at: Public Accounts Committee – Reports, special reports and government responses – Committees – UK Parliament. The issue has continued to be raised and discussed at the LALC.

We are committed to working with other stakeholders to find solutions to ensure that the position improves as rapidly as possible. We will continue to monitor the position and have discussed with the firms concerned their recovery plans to complete the audits as soon as possible. However, it is recognised that there are no quick or easy solutions to the developing issue of scarce auditor resources.

DLUHC has a vital role in helping to ensure co-ordinated action in response to Sir Tony Redmond’s recommendations and in overseeing the overall progress and performance of the local audit system.

PSAA also participates in the DLUHC Local Audit Monitoring Board, established to oversee the implementation and delivery of the Local Audit and Accountability Act 2014 (LAAA 2014). This group includes representatives of the regulatory bodies as well as relevant government departments.

We carry out annual monitoring of each contracted firm addressing both financial health and significant threats to reputation which might be relevant to the firm’s contractual responsibilities to PSAA. The results of this work are reported to the Board by the Chief Executive. We also publish quality monitoring reports on our website on the performance of our contracted firms and the quality of the audit services they deliver. Latest fee variation information is also included in these reports.

Other key suppliers of services to the company are: the LGA which provides our back-office support services and accommodation; and CIPFA which provides technical reports and publications including the sector Accounting Code. PSAA staff meet regularly with these suppliers to ensure positive relationships and early resolution of any concerns.

Wherever feasible, we use the services of smaller suppliers to support the general day-to-day running of our business.

Other stakeholders

Given our unique position within the local audit environment, we work with key stakeholders and regulators to ensure the quality of local audit services and are represented on various important fora.

Our other main stakeholders include DLUHC, the NAO, the FRC, ICAEW, and CIPFA. PSAA’s Chair and Chief Executive and/or officers attend regular meetings with these stakeholders as appropriate, with updates provided in the Chief Executive’s regular reports to the Board.

Following the publication of the Redmond review in September 2020 and DLUHC’s initial response in December 2020, we have provided DLUHC with detailed briefings in relation to our work under the appointing person regime and the development of our procurement strategy and processes. During the year we have also sought to keep the Department informed of emerging risks and issues.

In September 2021 we responded to the DLUHC consultation on the Local Audit Framework technical consultation which covered proposals to implement the Redmond recommendations, building on its Spring update report on Local Authority Financial Reporting and External Audit.

We engage with sector wide initiatives and contribute views and information for Government commissioned reviews and studies. In March 2021 the Department for Business, Energy and Industrial Strategy (BEIS) issued a consultation on a package of measures aimed at improving the UK’s audit, corporate reporting and corporate governance systems arising from the three independent reports produced by Kingman, the CMA and Brydon. We have responded and highlighted the potential impact of these recommendations for the local audit sector.

We responded to DLUHC’s consultation on proposed changes to the Local Audit (Appointing Person) Regulations which have now been laid before Parliament and passed into law. The changes to the regulations provide PSAA as the appointing person with greater flexibility in relation to fee setting and fee variations, to ensure the recurring costs to audit firms of additional work are built into scale fees in a more timely, flexible and seamless way.

(d) The impact of the company’s operations on the community and the environment

The Board regards local audit as an important cornerstone of local accountability. PSAA’s most significant contribution to the community therefore lies in its responsibility to ensure that affordable, audits which meet quality standards continue to be delivered at every opted-in body by competent suppliers.

The LGA provides PSAA with a range of support services, including provision of serviced accommodation, HR, ICT and payroll support. This agreement was renewed for a three-year period commencing in April 2021. As well as securing operating efficiencies and economies of scale, this arrangement enables PSAA to subscribe to and participate in a range of LGA policies and initiatives. These include an office recycling scheme and use of energy efficient office equipment. Our aim is to reduce our environmental footprint by:

- continually reducing waste and increasing our recycling rate;

- reducing paper use;

- ensuring that procurement of goods and services adheres to the green purchasing and procurement policy; and

- complying with all applicable legislation, regulation and other relevant requirements relating to our environmental impacts.

Due to the measures put in place in response to the pandemic, remote working has had a beneficial impact on the environment. As we emerge for the pandemic and are able to return to the office in some capacity, we will review our flexible working policy and will consider our environmental impact as part of this review.

Our current appointing person procurement scheme established in 2017 requires suppliers to identify the social value benefits which would accrue from any contract award. This secured commitments to apprenticeships, training and other arrangements. Our on-going monitoring of the contract reviews performance against this commitment. Across our five firms over 400 positions were to be provided across the life of the contract with 90 in place in the first year. Initial information shows that 243 apprenticeships and other training positions were introduced in the first two years of the contract.

Customers and their local communities will benefit from the value for money achieved from our procurement exercises and the periodic reimbursement of surplus funds.

Our staff complete mandatory e-learning training modules on dignity at work and equality in the workplace and awareness of modern slavery. The Board annually approves a statement on modern slavery which is published on the website.

(e) The desirability of PSAA maintaining a reputation for high standards of business conduct

High standards of corporate governance are a key factor in underpinning the integrity and efficiency of PSAA. We believe they are critical in helping us to achieve our core objectives as set out in our Articles of Association. Our arrangements draw on a number of good practice sources including the principles set out in the Code of Conduct for Board Members of Public Bodies (issued by the Cabinet Office) and in the UK Corporate Governance Code, to the extent that the latter can be applied to a small company without shareholders. We have a robust corporate governance framework which is reviewed annually to ensure that it remains fit for purpose and publish full details on our website. Further details are included in Section 3 of the Strategic Report on Risk Management (page 24) and within the Governance Report on pages 36 to 38.

We aim to be as transparent as possible about our business, finances, statutory responsibilities and governance including making information available in accordance with the Local Government Transparency Code. From April 2019 PSAA has been subject to the requirements of the Freedom of Information Act. PSAA’s publication scheme is available on our website and provides detailed information about the company and its functions.

2. Business review

In our seventh full year of business, covered by this report, the company has focused on discharging its appointing person responsibilities against a backdrop of increasing turbulence in the local audit sector whilst also turning our attention to preparation for the next appointing period.

Auditor appointments

Appointments made for the five years of the current appointing period cover audits of the accounts for the period 2018/19 to 2022/23. In order to be eligible for our contracts, firms had to be approved by a relevant recognised supervisory body. The five suppliers contracted to provide audit services to opted-in bodies are set out below:

| Lot | Firm | PSAA market share |

| 1 | Grant Thornton UK LLP | 40% |

| 2 | Ernst and Young LLP | 30% |

| 3 | Mazars LLP | 18% |

| 4 | BDO LLP | 6% |

| 5 | Deloitte LLP | 6% |

At 1 April 2021 there were 476 local government bodies eligible to be members of the PSAA scheme, 467 (98%) of which had opted in. This high level of support from eligible bodies has enabled us to offer a scheme which maximises benefits and provides excellent value for money for participating bodies.

There are small changes every year in the number of eligible bodies as a result of local government reorganisations or the establishment of new bodies. A full list of opted-in bodies is maintained on our website in accordance with the Local Audit (Appointing Person) Regulations 2015. List of auditor appointments and scale fees – PSAA

Second appointing period

In May 2021 the Secretary of State confirmed that PSAA would continue as an appointing person under the LAAA2014.

The company began a significant programme of work in the latter part of 2020/21 to develop its offer for the national appointing person scheme for the second appointing period that will commence in April 2023, invite eligible bodies to opt into its national scheme, and undertake a procurement to let new contracts with audit firms.

Eligible bodies had from 22 September 2021 to 11 March 2022 to decide and notify PSAA if they wished to join the national scheme for the second appointing period. This period was well in excess of the minimum requirement of eight weeks under the regulations but was very necessary given the reduced frequency of full council, or equivalent, meetings and the impact of Covid-19. By the time the window for notifications closed we had received 470 opt-in acceptances with only 5 eligible bodies preferring to make local arrangements for their auditor appointment.

We launched two procurements, one for the main procurement of audit services for the period covering the audit of accounts from 2023/24 to 2027/28 and one to establish a dynamic purchasing system (DPS) from which audits can be procured on a more ad hoc basis, for example, in situations where a change of auditor is required or as a result of new eligible bodies joining the scheme, for example due to local government reorganisations. New suppliers can apply to join the DPS at any time. We anticipate that this will encourage new entrants to the market.

Tenders in relation to the main procurement are due to be returned on 11 July 2022. A successful outcome will enable the award of contracts to successful suppliers during August 2022 and appointment of auditors to bodies later in the year. If the outcome does not identify all of the audit capacity required a number of contingency options will come into play including the possible extension of one or more existing contracts and/or use of the DPS.

Setting audit fees

PSAA’s statutory appointing person responsibilities include specifying a scale or scales of fees for the audit of accounts of opted-in bodies. The regulations applicable up to the end of 2021 required PSAA to set the fee scale before the start of the financial year to which the fees relate. From 2022 the fee scale must be set before December of the relevant financial year. The fee scale cannot be amended once it has been set.

A significant proportion of audit work is undertaken after the close of the relevant financial year by necessity. Setting the fee scale in advance of the start of that year therefore presents significant challenges when audit is subject to as much change as it is currently. Ideally, we would be able to set fees with the benefit of relatively complete information about all preceding years’ audits. In practice, we had to consult in January 2021 on the 2021/22 fee scale with incomplete information in relation to:

- audits of 2018/19 accounts, for which a minority of audit opinions remained outstanding;

- audits of 2019/20 accounts (a significant proportion of opinions remained outstanding at that time or fee variations had not been submitted for determination); and

- audits of 2020/21 accounts (very limited if any audit work had been done at the time the fee scale was set in March 2021).

The new deadline of December for setting the fee scale, following the introduction of amended regulations in early 2022, should enable PSAA to base its fee scale consultation on more complete and up to date information on audit fees and requirements, depending on the position on delayed audit completions.

The regulations provide for PSAA to consider requests for additional audit fees from audit firms where substantially more work is needed than was envisaged when the fee scale was set. Such requests can generally be considered once the audit is complete and are managed under PSAA’s fee variations process. Fee variation requests have been increasing in volume and value in response to greater regulatory scrutiny of auditors’ work and changes in audit requirements such as revised auditing and accounting standards and the new Code of Audit Practice.

In cases where PSAA could determine an additional fee nationally or for groupings of bodies, the updated regulations allow for this with some conditions. PSAA has consulted on changes to current fee variations arrangements with the aim of reducing, if possible, the volume of local discussions about fee variations. On the basis of the outcome of the consultation PSAA has:

- implemented a programme of research to consider the likely impact on audit work and fees of some expected changes in audit requirements;

- worked with DLUHC on changes to the regulations to provide the appointing person with greater flexibility in relation to fee setting and fee variations, to ensure the recurring costs to audit firms of additional work are built into scale fees in a more timely, flexible and seamless way; and

- introduced an updated rate card applicable to additional fees.

The challenges facing the local audit environment are such that they do not lend themselves to immediate or easy solutions. Nevertheless, PSAA is continuing to work closely with stakeholders to develop solutions and help to build a more resilient sustainable system.

Fee variations

Fee variations are the mechanism by which PSAA approves additional audit fees. Additional fees are required when an auditor needs to undertake substantially more work than was envisaged when the fee scale for the audit was set by PSAA. This is an increasingly common occurrence in the current climate, which is very different from the previously relatively stable conditions for local audit.

Since PSAA’s current contracts with audit suppliers were let in 2017, audits have been subject to increased scrutiny and regulatory pressures following some controversial financial failures in the private sector. Additional work has been required at most audits to enable a safe audit opinion on the financial statements and to meet rising regulatory requirements. Changes in audit requirements, including the requirement for a VFM arrangements commentary in the Code of Audit Practice 2020 for audits from 2020/21, and some updated auditing and accounting standards have placed further pressures on audit fees. These pressures have been compounded by the restrictive statutory fee setting timetable before 2022, leading to an increasing need for fee variations for additional audit work.

Auditors are obliged to have local discussions with individual opted-in bodies about any proposed fee variations. These discussions should take place at the earliest opportunity, and wherever possible the auditors should highlight at the planning stage any additional work which is likely to be required during the audit, including potential fee implications. While it may not be possible to quantify the proposed fee until the work is done, early discussion can help to avoid misunderstandings at a later stage. Where fee variations relate to ongoing audit requirements, PSAA is building the approved variations into scale fees at the earliest fee setting opportunity.

We have previously reported the level of increase in fee variations from the audit year 2018/19 to 2019/20 where fee variations rose from £4.835m to £10.222m. We expect the level of fee variations for the audit year 2020/21 to be even higher than for 2019/20 due to the factors set out above. At the date of this report, fee variations for 2020/21 total £3.027m with a large number of anticipated claims still to be submitted to PSAA. The table below provides a summary of the number of fee variations we are expecting for audit years 2019/20 and 2020/21 compared to the audit year 2018/19.

Number of fee variations

| Audit year | 2018/19 actual | 2019/20 expected | 2020/21 expected |

| Number of FVs submitted | 1,040 | 3,200 | 4,700 |

| % Change compared to 2018/19 | 208% | 352% |

Contract monitoring arrangements

We have robust contract monitoring arrangements in place to manage the contracts with the audit firms, and to fulfil our appointing person role and responsibilities. Ongoing contract management arrangements have the dual purpose of reporting results to opted-in bodies. They also ensure that PSAA meets its obligations under the Local Audit (Appointing Person) Regulations 2015 to monitor compliance of auditors with the requirements of our audit contracts and our associated terms of appointment which clarify the standards for performing the services under the contracts and provide a source of reference for matters of practice and procedure which are of a recurring nature.

We oversee any issues relating to the independence of our appointed auditors. This includes reviewing requests to provide non-audit consultancy services and monitoring the rotation of audit staff to minimise the threat of familiarity arising from long association.

We have a complaints process covering the carrying out of audit work by the auditors we have appointed, but not the judgements they have independently reached.

Quality of audit services

One element of our contract monitoring framework is to monitor the quality of audit services.

The results of our monitoring are published annually in our summary Audit Quality Monitoring Review. Our latest review covering the 2019/20 audit engagements was published in March 2022. This was later than planned because of pandemic-induced delays for the Financial Reporting Council and Institute of Chartered Accountants in England and Wales in completing and reporting on their professional regulatory reviews.

We have adopted the International Auditing and Assurance Standards Board’s Framework for Audit Quality (the IAASB framework) as the model for the appointing person quality of audit services monitoring arrangements. Audit quality formed a core part of the evaluation of tenderers in the 2017 audit services procurement, with tenderers also encouraged to have regard to the IAASB framework in their responses.

Our approach is based on the expectation that good quality audit services are likely to be achieved by an engagement team that:

- exhibits appropriate values, ethics and attitudes;

- is sufficiently knowledgeable, skilled and experienced and has sufficient time allocated to perform the audit work;

- applies a rigorous audit process and quality control procedures that comply with law, regulation and applicable standards;

- provides useful and timely reports; and

- interacts appropriately with relevant stakeholders.

While responsibility for the quality of an audit rests ultimately with the auditor, audit quality, efficiency and effectiveness are shared responsibilities. The IAASB framework notes that all parts of the financial reporting supply chain (including audit firms, regulators, standard setters and audit committees) have a role in contributing to and encouraging an audit environment that supports audits which meet quality standards. There is a complex interplay of many factors. We have taken the attributes that the IAASB Framework expects to be present within an audit and distilled them into three key tests:

- adherence to professional standards and guidance, obtained from the results of professional regulatory reviews;

- compliance with contractual requirements, obtained from monitoring; and

- relationship management obtained from client satisfaction surveys.

We commission the LGA Research Team to conduct a survey to obtain opted-in bodies’ feedback on their audits each year. The survey arrangements are an important strand of our Quality Monitoring and Reporting Framework and the survey responses have provided us with the opportunity to identify good practice and discuss specific areas for improvement with individual audit firms. We report the survey results separately as soon as available.

We have also continued to pay close attention to the results of audit inspections carried out by the FRC and the ICAEW and to discuss any key issues arising with suppliers.

Transitional arrangements

PSAA has been responsible since 1 April 2015 for specific functions delegated to it on a transitional basis by the then Secretary of State for Communities and Local Government. These responsibilities included appointing auditors and setting fees for principal local government and NHS bodies, making arrangements for housing benefits subsidy claim certification, and managing contracts novated to PSAA on the closure of the Audit Commission in March 2015. In December 2020 the Secretary of State extended these transitional powers for a further three years to 31 December 2023.

The outstanding elements of this work relate mainly to the 2017/18 audits of local government bodies. At 31 March 2022 audit closure certificates had not been issued at 20 principal authorities as a result of ongoing audit work under the transitional arrangements on financial statements (four authorities) or outstanding electors’ objections or where other investigative work has to be concluded. There are also two small authority bodies where certificates and opinions have not been issued.

3. Risk Management

Risk management arrangements

PSAA has in place a risk management framework which:

- provides assurance to the Board that strategic and operational risks are being managed effectively to ensure that objectives can be achieved;

- ensures that risk management is an integral part of PSAA’s culture and operations;

- contributes to making informed decisions and effective resource planning; and

- inspires trust and confidence with our key stakeholders.

The Board is responsible for taking a balanced view of the company’s approach to managing opportunity and risk. The Board’s responsibilities include:

- ensuring that effective arrangements are in place to provide assurance on risk management, governance and internal control;

- ensuring that the risks faced are dealt with in an appropriate manner, in accordance with relevant aspects of best practice in corporate governance; and

- approving the risk management strategy and setting the risk appetite.

As a company responsible for handling public money, PSAA’s tolerance of risk is generally low.

The audit committee is responsible for reviewing and challenging the company’s assessment and management of risk and the adequacy of internal controls established to manage strategic and operational risks identified. The audit committee scrutinises the corporate risk register at each meeting and on occasions asks for further reports or presentations on specific risks as it considers necessary. The audit committee chair reports to the Board at each meeting on risk management.

The Chief Executive is responsible for maintaining the company’s system of internal control and assurance, providing the Board and audit committee with assurance on its ongoing effectiveness and appropriateness, and advising on any material changes.

The PSAA team reviews the corporate risk register on a regular basis and specific members of the management team are responsible for managing the individual risks. The review includes identification of appropriate actions to ensure that risks are mitigated and consideration of any new risks that should be added to the risk register.

As part of the preparations for the next appointing period a project risk register was established. This is regularly reviewed by both the Board and audit committee. Following completion of the next appointing period project, any residual risks to be managed will be subsumed within the corporate risk register.

Current risks

During the year PSAA has monitored the potential risks to the company being able to achieve its objectives and has put in place mitigating actions wherever possible.

The significant risks facing PSAA are that:

- an audit supplier does not meet PSAA’s contractual requirements in terms of delivery and fails to deliver audits on a timely basis;

- a protracted period of inertia and uncertainty in the audit world impacts on PSAA’s scheme and procurement, and the wider local audit framework; and

- the objectives of PSAA’s main procurement are not fully met and do not identify sufficient audit capacity to meet all of the scheme’s requirements.

The audit committee and the Board are sighted in relation to these risks and regularly monitor the arrangements in place to manage them, recognising that many of the risks arise from the turbulence in the local audit sector and market which are, to a large extent, factors beyond our control. However, wherever possible, we have sought to raise risks to the sustainability of the local audit sector and emerging issues with system stakeholders, in order to influence the sector-wide response to risk.

Future risks

Longer term there are a number of wider challenges which have the potential to impact on local audit, opted-in bodies and PSAA. These include:

- possible changes in audit regulation, auditing standards and audit firms;

- the challenge of ensuring that the local audit system as a whole works effectively and meets the needs of opted-in bodies and users of accounts;

- the need to maintain a sustainable, competitive local audit market; and

- the related challenge to ensure an adequate supply of suitably qualified and experienced audit staff.

In December 2021 and May 2022, Board workshops considered the implications of a number of scenarios which could arise from the outcome of the procurement and, through an assessment of the risks, produced an action plan to mitigate those risks.

Whilst the Redmond Review has helped to raise the profile of these issues, PSAA continues to commission research and to work closely with other stakeholders to explore and strive to identify options to address these important challenges.

4. Financial review

Being financially responsible

PSAA is committed to securing value for money, ensuring it delivers its objectives while minimising costs. PSAA strives to be financially responsible by:

- exercising financial discipline and maintaining a robust control environment;

- keeping running costs to a minimum;

- returning surplus funds to opted-in bodies;

- ensuring the company’s internal auditors review the internal control environment annually to provide assurance on the financial controls and confirm these are working as intended;

- meeting the company’s statutory obligations; and

- meeting PSAA’s duties as a good employer.

The company’s internal auditors, TIAA Limited, perform an annual work programme, which covers key systems and aspects of the control framework. The results of this work programme are included in the Governance report on page 36.

Turnover and profit on ordinary activities

The revenue received by PSAA must cover the costs of paying auditors for work under the audit contracts and the operating expenses of PSAA.

PSAA’s accounts show a £nil profit for the 12 months to 31 March 2022 as revenue is matched to expenditure and any monies not required to cover costs are returned to opted-in bodies at appropriate intervals.

Revenue, including investment income, for the 12 months to 31 March 2022 was £32.911 million (2020/21 £30.535 million) which covered the costs including corporation tax incurred by PSAA for the period 1 April 2021 to 31 March 2022 of £32.911 million (2020/21 £30.535 million). The increase in revenue and associated audit costs are mainly due to higher levels of fee variations expected for audit year 2021/22.

Controlling costs

PSAA incurred total costs of £32.911 million, of which the cost of the audit contracts for the period was £31.401 million, 95.5% of total costs (2020/21: £29.240 million which represented 95.8%).

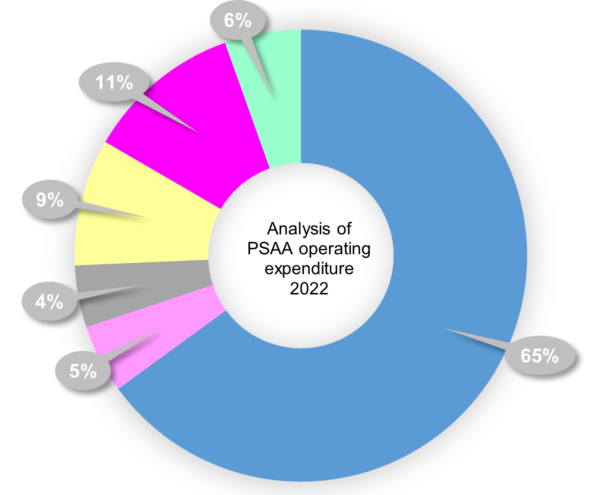

The chart shows the split of PSAA incurred operating expenses of £1.510 million in 2021/22. This represents 4.5% of total costs (2020/21: £1.293 million which represented 4.2% of total costs) and taxation of £0.0002 million (2020/21: £0.002 million).

The increase in operating costs is due to the procurement which commenced during 2021/22.

Financial position

PSAA’s total assets equal total liabilities at the end of 31 March 2022 (31 March 2021: total assets also equalled total liabilities). PSAA is required to pay any surplus funds to opted-in bodies, as provided for in its Articles of Association. Surplus funds are shown as a liability in the balance sheet as part of deferred income. The deferred income is regularly reviewed to ensure PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. Funds no longer required are returned once approved by the Board.

PSAA distributed £5.600 million to opted-in bodies in September 2021. This leaves approximately £5.610 million in long-term deferred income (see note 13 on pages 49 to 50).

Future developments

The financial year 2022/23 will be another significant one for local audit and PSAA. The company will continue to discharge its appointing person responsibilities in relation to the first appointing period and conclude its preparations for the second appointing period. It will continue to ensure that both these workstreams are completed to required standards and timescales.

By order of the Board

Steve Freer

Chairman

6 July 2022