Strategic report

The directors present their strategic report for the year ended 31 March 2024.

1. Objectives and operating environment

PSAA’s responsibilities and aims are expressed through a series of objectives, set out in our Articles of Association, covering the following areas of activity:

- appointing auditors to relevant authorities;

- consulting on and setting a scale or scales of fees, and charging fees, for the audit of accounts of relevant authorities;

- ensuring that public money from audit fees continues to be accounted for properly and is protected;

- overseeing the delivery of consistent, high quality and effective audit services to relevant authorities;

- ensuring effective management of contracts with firms for audit services to relevant authorities;

- being financially responsible having regard to the efficiency of operating costs and transparently safeguarding fees charged to opted-in bodies; and

- leading our people as a good employer.

During 2024 we hope to agree a new memorandum of understanding (MoU) with key partners including MHCLG and the LGA setting out the broad framework within which PSAA operates. A similar MoU was agreed in 2015 but now needs to be updated.

The Board believes that strong and effective corporate governance supports the future long-term success of PSAA. It has in place, and regularly reviews and updates, a comprehensive governance framework to support the company’s functions as an appointing person.

Whilst our core functions as an appointing person remain unchanged, continuing to operate in a complex and evolving environment means that communication and engagement with opted-in bodies and wider stakeholders remains a hugely important part of our work.

2. Business review

This report covers our ninth full year of business. Our audit services contracts for the second appointing period began in April 2023 and embedding our contract monitoring arrangements has been a particular focus of this year.

Auditor appointments from 2018/19 to 2027/28

Our first set of contracts with five firms covered audit appointments for 2018/19 to 2022/23. Contracts continue until every audit under it has been delivered, and so proposals to implement backstop dates could heavily influence the end point.

Our procurement for firms to deliver 2023/24 to 2027/28 audits did not secure enough capacity for us to appoint to all bodies that opted into our scheme. We carried out a rapid response supplementary procurement and managed to obtain the further capacity required.

The firms’ market shares across our two appointment periods are as follows:

| Firm | PSAA market share 2018/19-2022/23 % | PSAA market share 2023/24 – 2027/28 % |

| Grant Thornton UK LLP | 40.00 | 36.00 |

| Ernst and Young LLP | 30.00 | 20.00 |

| Forvis Mazars LLP | 18.00 | 22.50 |

| KPMG LLP | – | 14.00 |

| Bishop Fleming LLP | – | 3.75 |

| Azets Audit Services Ltd | – | 3.25 |

| BDO LLP | 6.00 | – |

| Deloitte LLP | 6.00 | – |

For the first appointing period 98% of eligible bodies opted in. For the second appointing period, 456 eligible bodies (over 99%) chose to opt into the national scheme, with only 4 eligible bodies preferring to make local arrangements for their auditor appointments.

This high level of support from eligible bodies has enabled us to offer a scheme that strives to maximise benefits for participating bodies.

There are small changes every year in the number of eligible bodies because of local government reorganisations and/or the establishment of new bodies. Where a new eligible body chooses to opt into the scheme, PSAA is charged with finding an auditor. Making occasional appointments because of this process is becoming increasingly difficult because of the paucity of the market.

A full list of opted-in bodies is maintained on our website in accordance with the regulations. List of auditor appointments and scale fees.

Alongside the main audit services procurement, we established a dynamic purchasing system (DPS). This offers several benefits including providing an alternative source from which to seek new appointments when required. It also enables firms without a main audit services contract to bid for our work and provides greater flexibility in our approach to future procurements.

Independent review of the 2022 procurement

During 2023 independent consultants Touchstone Renard carried out a ‘lessons learnt’ review of our work to develop the national auditor appointment scheme for the audits from 2023/24. Independent review of PSAA’s preparations for the second appointing period. The review focused on:

- reviewing, assessing and commenting on the effectiveness of our external communications and engagement activities for the project; and

- providing an independent, insightful view informed by external stakeholder feedback as to whether we could have adopted different or better approaches to any aspects of our preparations.

The review concluded that PSAA had communicated and engaged effectively throughout all phases of the project in the face of major headwinds including the statutory limitations of our role and a fragile and under-resourced local audit market. The report has made a number of recommendations for PSAA including some relating to the next procurement. We are addressing these points as we review our processes.

The report also highlighted concerns for the wider local audit system to consider, reflecting the wide range of issues that respondents raised with Touchstone Renard that go beyond our role. We continue to raise these concerns ensuring that they are heard by the local audit system partners as work progresses to address the challenges.

Looking ahead to the next appointing period

We are already looking ahead to the next appointing period to the audits for financial year 2028/29 onwards and are considering the options for approaching the procurement and appointment of auditors.

Timeliness of audit completion

The challenges facing local audit which first emerged during the course of the audits of the 2018/19 accounts have continued to be a significant and escalating problem during subsequent years. The result is that at 31 March 2024 642 opinions are delayed, as summarised in the table below.

| Audit year Publishing date | Number of opted in bodies | Percentage of audits complete by publishing date | Number of audits outstanding per financial year at 31 March 2024 | Number of audits by oldest year outstanding |

| 2022/23 – 30 Sep | 467 | 1% | 348 (75%) | 164 |

| 2021/22 – 30 Nov | 467 | 12% | 184 (39%) | 111 |

| 2020/21 – 30 Sep | 474 | 9% | 73 (15%) | 48 |

| 2019/20 – 30 Nov | 478 | 45% | 25 (5%) | 16 |

| 2018/19 – 31 Jul | 486 | 57% | 9 (2%) | 8 |

| 2017/18 – 31 Jul | 494 | 87% | 1 | |

| 2016/17 – 30 Sep | 497 | 95% | 1 | |

| 2015/16 – 30 Sep | 497 | 97% | 1 | 1 |

| Total | 642 | 348 |

As at 30 June 2024, 559 opinions are delayed.

As set out in the Overview to our annual report, various reports and parliamentary committee hearings have highlighted the challenges facing the local audit system and the impact delayed auditor reporting. They have also set out that the cause is a mix of individual and systemic failures. The frustrations of all parties where audited accounts are not able to be published on a timely basis are well documented, as is the disruptive impact on the day-to-day delivery of other tasks.

The level of interest and concern demonstrated by the NAO, the PAC and the LUHC Select Committee is a reflection of the seriousness of the position and the potential implications for good governance, financial management and local accountability.

Setting audit fees

PSAA’s statutory appointing person responsibilities include setting a scale or scales of fees for the audit of accounts of opted-in bodies. The local audit regulations require PSAA to consult on and set the fee scale by 1 December of the financial year to which the fee scale relates. The fee scale cannot be amended after this date.

We recognise the significant financial pressures on all local government bodies and understand than any further cost pressure because of increased audit fees is unwelcome.

Many of the factors affecting the local audit system and which have led to higher audit fees and delayed audit completions are complex and outside PSAA’s remit. We have highlighted the need for urgent action to reform the local audit system in England and our view that radical changes are needed to achieve a more proportionate and timely audit and a more sustainable audit system.

We consulted on and set the 2023/24 fee scale between September and November 2023. The consultation explained the difficulties in setting the fee scale at a time of significant difficulties and change in the local audit system as set out in this report.

PSAA awarded the new contracts in 2022 to six audit firms, following a challenging and protracted procurement. It demonstrated the limited audit capacity available to meet the demands of the local audit market, and resulted in an increase of 151% on our audit fees.

We commission annual independent technical research on changes in local audit requirements. We construct our fee scale proposals each year using the resulting recommendations, our own information on fee variations, and other factors such as inflation.

Our consultation on 2023/24 scale fees proposed to update them as fully and consistently as possible for the start of the new appointing period. The elements of our strategy were:

| 2023/24 fee scale elements |

|---|

| A – The scale fees for 2022/23 Plus: B – Approved fee variations for recurrent additional audit work in prior years not yet included in scale fees, or estimates where audits have been delayed C – Changes in local audit requirements D – Adjustments at specific bodies for local circumstances E – Adjustment of 151% to total audit fees, for the procurement outcome |

We set the 2023/24 fee scale using the latest data available to us.

Fee variations

Fee variations are required when an auditor needs to undertake substantially more or less work than was envisaged when we set the fee scale for the audit.

Fee variations have increased in recent years, reflecting that local audit no longer operates in its relatively stable pre-2018 conditions. Auditors have needed to increase their work substantially to meet rising regulatory requirements including revised accounting and auditing standards, and producing a VFM arrangements commentary from 2020/21 onwards.

Auditors should have local discussions with bodies about any proposed fee variations at the earliest opportunity. Wherever possible the auditors should highlight at the planning stage any likely additional work, including potential fee implications. While it may not be possible to quantify the proposed fee until the work is complete, early discussion can help to avoid misunderstandings at a later stage. Where fee variations relate to ongoing audit requirements, we aim to build the approved variations into scale fees at the earliest opportunity.

The table below sets out the expected number of fee variations (as at 31 March 2024) over the last two financial years. The increase in larger fee variations reflects a rise in long-delayed audits coming to a conclusion, as typically they require the most complicated and input intensive work.

Number of fee variations

| Fee variation proposals submitted | April 2022 to March 2023 | April 2023 to March 2024 | % difference |

| <= £25,000 | 171 | 223 | 30% |

| >£25,000 and <= £50,000 | 79 | 129 | 63% |

| >£50,000 and <= £75,000 | 24 | 69 | 188% |

| >£75,000 and <= £100,000 | 10 | 36 | 260% |

| >£100,000 and <= £200,000 | 25 | 62 | 148% |

| >£200,000 | 4 | 24 | 500% |

| Total | 313 | 543 | 73% |

| Number of fee variations submitted | 1,664 | 3,628 | 118% |

Contract monitoring arrangements

Our contract monitoring arrangements reflect our statutory responsibility to monitor firms’ performance against the audit services contracts. It also enables us to report the results of auditors’ work to audited bodies and other stakeholders.

We oversee any issues relating to our auditors’ independence. This includes reviewing proposals to provide non-audit consultancy services and monitoring the rotation of senior audit staff to minimise the threat of familiarity arising from long association.

We have evolved our contract monitoring regime to align with the service delivery and compliance requirements in our new contracts, which are in line with feedback from bodies. We have restructured our staffing and created additional capacity to support the new regime.

We have regular dialogue with our contracted firms and formal quarterly meetings covering any issues, performance and contract compliance, and discussion on actions needed.

Quality of audit services

We are very aware that quality of audit service delivery is a high priority for our bodies. We work within the boundaries of our remit and the limitations of the local audit market, We endeavour to secure appropriate quality audit services through our contracts with firms, albeit that our remit and paucity of the supply market restrict how effective we can be in doing so.

We use the International Auditing and Assurance Standards Board (IAASB) Framework for Audit Quality as our model for monitoring the performance of auditors and the quality of the audit services they provide. It sets out the expectations for the provision of a good quality audit service, which we have distilled into three key tests:

- adherence to professional standards and guidance, obtained from the results of professional regulatory reviews;

- compliance with contractual requirements, obtained from monitoring; and

- relationship management, obtained from our annual client surveys.

We publish quarterly reports on our website to help bodies understand how we are monitoring the performance of audit firms on their behalf, along with other information such as the results of our client surveys.

The results of our monitoring are published annually in our summary Audit Quality Monitoring Review, incorporating the results of the latest professional regulatory reviews undertaken by the FRC and ICAEW. Our latest annual review (Audit Quality Monitoring Report 2023) was published in February 2024.

As expected, the timeliness of audit delivery is seen by audited bodies as the single factor that most impacts on their view on the quality of the audit service they currently receive.

Other projects

We have delivered on other projects during the year. We strengthened our data security arrangements by implementing multi factor authentication (MFA) across all our systems. We performed a major refresh of our website to improve communication with stakeholders and reviewed the arrangements for the provision of our support services.

Transitional arrangements

PSAA has been responsible since 1 April 2015 for specific functions delegated to it on a transitional basis by the then Secretary of State for Communities and Local Government. In December 2023 the Secretary of State extended these transitional powers for a further five years to 31 December 2028 to enable us to deal with the outstanding elements of this work. At 31 March 2024 audit closure certificates have not been issued at 10 principal authorities as a result of ongoing audit work on financial statements, outstanding electors’ objections, or where other investigative work has to be concluded. There also remains one smaller authority where the certificate and opinion has not been issued.

3. Risk Management

Risk management arrangements

PSAA has in place a risk management framework which:

- provides appropriate assurance to the Board on the degree to which strategic and operational risks and issues are being managed effectively in relation to the company’s objectives;

- ensures that risk management is an integral part of PSAA’s culture and operations; and

- contributes to making informed decisions and effective resource planning.

The Board is responsible for taking a balanced view of the company’s approach to managing opportunity and risk. The Board’s responsibilities include:

- ensuring that effective arrangements are in place to provide assurance on risk management, governance and internal control;

- ensuring that the risks and issues faced are dealt with in an appropriate manner, in accordance with relevant aspects of best practice in corporate governance; and

- approving the risk management strategy and setting the risk appetite.

As a company responsible for handling public money, PSAA’s tolerance of risk is generally low.

The Chief Executive is responsible for maintaining the company’s system of internal control and assurance, providing the Board and Audit Committee with assurance on its ongoing effectiveness and appropriateness, and advising on any material changes.

The Chief Operating Officer and Deputy Chief Executive provides oversight of risk management arrangements and is the Senior Information Risk Officer.

The PSAA team reviews the corporate risk register on a regular basis to assess mitigations and new risks, and specific members of the management team are responsible for managing individual risks.

The Board has delegated routine oversight of PSAA’s risk management to the Audit Committee (AC). The exact scope and duties of the AC are documented in its terms of reference, which are reviewed annually by the AC. The AC meets three times per year and the AC Chair reports back to the Board after every meeting.

The AC is responsible for reviewing and challenging the team’s assessment and management of risk, and the adequacy of the internal controls established to manage strategic and operational risks. The AC scrutinises the corporate risk register at each meeting and asks for further information as it considers necessary.

Current risks and issues

During the year PSAA has monitored the potential risks to achievement of our objectives. Mitigating actions were put in place wherever possible.

A significant number of risks in our register which are outside of our control have become issues reflecting the crisis in local government audit. This is demonstrated by the size of the local audit backlog. Sector stakeholders are working together to resolve the issues.

Many of the risks in our register arise from matters which are largely beyond our direct control. We have raised with system stakeholders the risks to the sustainability of local audit and other issues to inform the sector-wide risk assessment and response. During the year we have contributed to the development of a local audit system risk register.

There are a number of significant risks currently facing PSAA. These include that:

- if progressed by the new Government, a proposed solution to the audit backlog may have a number of consequences for PSAA, including a significant impact on fee variations and PSAA’s capacity to process these; and

- the continuing uncertainty within the local audit sector could result in further challenges in market capacity.

Future risks

Over the next few years we expect there will be wider challenges and further change within the local audit system. These include:

- if a backlog solution is adopted by the Government there will be a number of implications including consequences for audit fee variations and the build back of audit assurance;

- if the proposal to create ARGA is adopted and ARGA is given system leadership, there will be challenges to ensure that the local audit system as a whole works effectively and meets the needs of audited bodies and users of accounts;

- the need for the FRC to develop and to maintain a sustainable, competitive local audit market;

- possible changes in audit regulation, auditing standards and audit firms;

- the related challenge to ensure an adequate supply of suitably qualified and experienced audit staff; and

- our preparation for the next appointing period and consideration of our approach to securing sufficient auditor capacity.

4. Financial review

Being financially responsible

PSAA is committed to securing value for money, ensuring it delivers its objectives while minimising costs. PSAA is a not-for-profit organisation and strives to be financially responsible by:

- exercising financial discipline and maintaining a robust control environment;

- keeping running costs to a minimum;

- returning surplus funds to opted-in bodies;

- ensuring PSAA’s internal auditors review the internal control environment annually to provide assurance on the financial controls and confirm these are working as intended;

- meeting PSAA’s statutory obligations; and

- meeting PSAA’s duties as a good employer.

The internal auditors, TIAA Limited, perform an annual work programme which covers key systems and aspects of the control framework. The results of this work programme are included in the governance report on page 36.

Turnover and profit on ordinary activities

The revenue received by PSAA must cover the costs of paying auditors for work under the audit contracts and the operating expenses of PSAA.

PSAA’s accounts show a £nil profit for the 12 months to 31 March 2024 as revenue is matched to expenditure and retained. Any monies that we are satisfied are not required to cover our costs are returned to opted-in bodies.

For the 12 months ending 31 March 2024, our revenue was £52.401 million (2022/23: £40.838 million). A surplus of £2.831 million was transferred to deferred income aligning revenue with costs of £52.401 million. This practice allows us to absorb any surplus or deficit in a given year.

Controlling costs

PSAA incurred total costs of £52.401 million, of which the cost of the audit contracts for the period was £50.630 million, 96.6% of total costs (2022/23: £39.341 million which represented 96.3%).

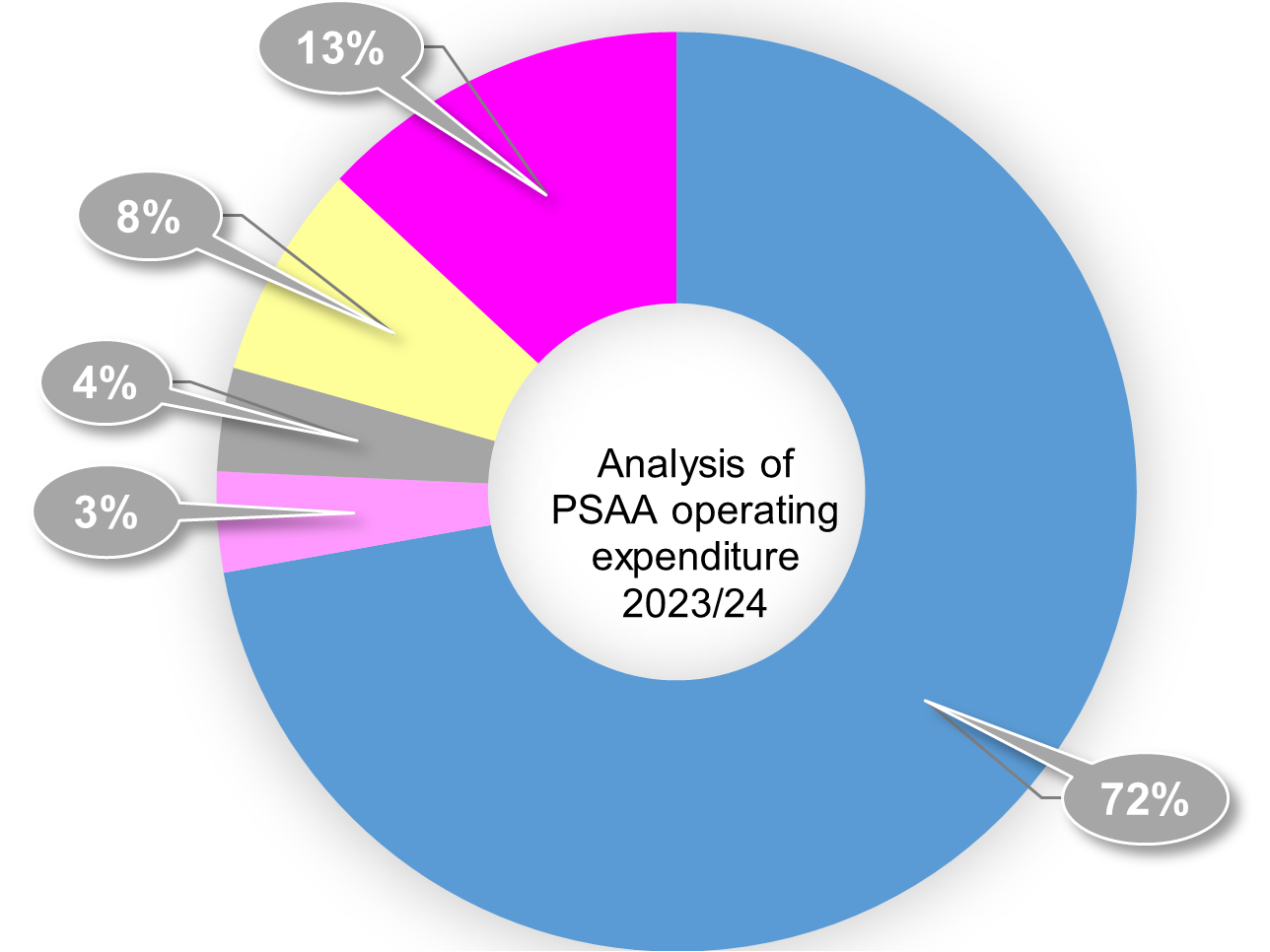

The chart shows the split of PSAA incurred operating expenses of £1.771 million in 2023/24. This represents 3.4% of total costs (2022/23: £1.473 million which represented 3.7% of total costs) and £nil taxation (2022/23: £nil).

Financial position

PSAA’s total assets equal total liabilities at the end of 31 March 2024 (31 March 2023: total assets also equalled total liabilities). PSAA is required to pay any surplus funds to opted-in bodies, as provided for in its Articles of Association. Surplus funds are shown as a liability in the balance sheet as part of deferred income. The deferred income is regularly reviewed to ensure PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. Subject to Board approval, funds no longer required are returned to relevant bodies.

Future developments

During 2024/25 the company will continue to discharge its appointing person responsibilities in relation to the first appointing period and administer a robust contract and financial monitoring framework for the new audit services contracts which commenced on 1 April 2023. PSAA will continue to ensure that both these workstreams are performed to required standards and timescales.

Bill Butler

Chair

09 August 2024